Support & Membership Frequently Asked Questions

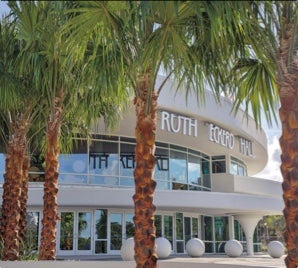

Thank you for your interest in supporting Ruth Eckerd Hall’s mission. Below please find frequently asked questions regarding memberships and charitable contributions to the hall.

If your question is not answered here, please contact us at ksamy@rutheckerdhall.net.

Ways to Donate

Ruth Eckerd Hall, Inc. is pleased to accept contributions via your preferred donation method. If you require further assistance, please email ksamy@rutheckerdhall.net.

Online

Visit our support page, where you can learn about Membership, Corporate & Grantor support and Planned Giving. You can also make a direct donation to our mission here

Phone

Please call us at 727.712.2720 between 10 a.m. and 6 p.m.

Please mail contributions to the below address. Please make any checks payable to Ruth Eckerd Hall, Inc., and add any specific designations or restrictions to the “notes” field.

Ruth Eckerd Hall, Inc.

Attn: Development

1111 McMullen Booth Rd

Clearwater, FL 33759

Wire/ACH Transfers

Bank Account Title: Ruth Eckerd Hall Inc.

Bank Account Number: #23244111 (do not add leading zeros)

ACH Routing Number: 021052053

Wire Routing Number: 065503681

Wire Swift Code: WHITUS44

If further information is needed or if you have any questions, please contact:

Joe Fontana

Hancock Whitney Bank

2202 N. Westshore Blvd., Suite 150

Tampa, FL 33607

813-868-7867

Stock Donations

Ruth Eckerd Hall is pleased to accept donations of publicly traded securities. To initiate a stock transfer, please contact Kate Samy, Vice President & Chief Development Officer, at ksamy@rutheckerdhall.net.

Donor Advised Funds

We gladly accept donations via Donor Advised Funds. Please note that due to IRS regulations regarding these types of donations, Ruth Eckerd Hall may be unable to accept them as payments for gifts which entitle you to tangible benefits such as Membership or special event payments. We are also unable to accept bifurcated gifts via donor advised fund for any gifts which entitle you to tangible benefit, as the Treasure Department and IRS view both payments as inextricably linked. Please consult your DAF administrator for guidance regarding restrictions on these gifts.

Tax ID

Ruth Eckerd Hall, Inc. is a registered 501(C)(3) nonprofit; Federal Tax ID #59-1803628.

Ruth Eckerd Hall, Inc. Florida Registration #CH1562 receives 100% of all contributions.

Florida Giving Notice

Important Notice Regarding Gifts

In keeping with Florida S.B. 700 (2025), Ruth Eckerd Hall is committed to complying with state regulations regarding charitable contributions.

By making a gift, you confirm that you are not a citizen, resident, or entity of the People’s Republic of China, Russian Federation, Islamic Republic of Iran, Democratic People’s Republic of Korea, Republic of Cuba, Venezuelan regime of Nicolás Maduro, or Syrian Arab Republic, and that you are not acting on behalf of or controlled by any such government, entity, or individual. You also confirm that your contribution is not made on behalf of any “foreign source of concern,” as defined by Florida law.

We appreciate your generosity and your support of Ruth Eckerd Hall’s work to bring the arts to our community.

Donation Questions

Why does Ruth Eckerd Hall need my support? Aren’t ticket sales enough?

As a non-profit performing arts organization, earned revenue like ticket sales and event rentals only cover a portion of our operating costs. We rely on support from individual donors, corporate partners and Grantors to fulfill our mission.

Your gift ensures that Ruth Eckerd Hall will continue to bring the best entertainment to the Tampa Bay region and maintain quality arts education and outreach programs that enrich our community.

Do I receive benefits in exchange for my donation?

Ruth Eckerd Hall memberships at all levels entitle you to varying benefits at our venues. Please visit our membership page to review our membership levels and benefits.

I need another copy of my donation acknowledgement. How can I request this?

Please email ksamy@rutheckerdhall.net and we’ll be happy to send you a copy of your tax receipt.

Can I make a donation in honor of someone?

Of course. To make a donation in memorial please contact Laurel Bennett, Director of Development Operationsat ksamy@rutheckerdhall.net.

Membership Questions

What is the difference between a membership and a direct donation?

Both memberships and direct donations are considered charitable contributions to Ruth Eckerd Hall. Memberships are a special type of donation that entitles you to special benefits at our venues.

When you become a member of Ruth Eckerd Hall at any level, you’ll receive special benefits like members-only advanced ticket purchasing, access to donor lounges and special perks throughout our venues. Because some of our membership level include benefits that are tangible goods or services, some membership gifts are not fully tax deductible. You may choose to decline tangible membership benefits to receive a full tax deduction. Please consult your financial advisor for more information about your charitable contributions.

You can support Ruth Eckerd Hall without becoming a member by making a direct donation here.

How long does my membership last?

Memberships are active for one year from the date of contribution. You will receive a renewal notice approximately two months prior to your membership expiration date.

Can I share my membership benefits with friends and family?

Ruth Eckerd Hall memberships are non-transferrable and may not be shared between multiple households. Membership benefits apply to only those who reside in your household.

How does member ticketing work?

Members at all levels enjoy the ability to purchase tickets for events presented by Ruth Eckerd Hall ahead of eClub and the general public. Members receive advanced notification of new on-sales via email, and may purchase tickets online, at our box office or via phone during their designated on-sale time (dependent on level).

To ensure you receive all advance show announcements, notifications and update, please add maildelivery@rutheckerdhall.net to your safe sender list and check your email and mailing addresses are up to day. Most notifications are only sent via email, so be sure you check often.

I lost my membership card, can I get a new one?

Please contact membership@rutheckerdhall.net to request a replacement membership card.

How do I get in to the Dress Circle lounge?

Members at the Dress Circle level and above enjoy year-round access to our members-only Dress Circle lounges at Ruth Eckerd Hall and the Nancy and David Bilheimer Capitol Theatre. To learn more about the elevated benefits that come with Circle of Stars membership, contact Kellie Mallory at k.mallory@rutheckerdhall.net.

To learn more about all membership levels and benefits, please visit our membership page.